| Date of UDP data | Date of aerial photography |

|---|---|

| 2021 | October/December 2021 |

| 2020 | October/November 2020 |

| 2019 | October/November 2019 and December 2019 to March 2020 |

| 2018 | January 2019 |

| 2017 | January 2018 |

| 2016 | January 2017 |

| 2015 | January 2016 |

| 2014 | February 2015 |

| 2013 | December 2013 |

| 2012 | January 2013 |

| 2011 | December 2011 |

| 2010 | December 2010 |

| 2009 | December 2009 |

| 2008 | January 2009 |

| 2007 | December 2007 |

| 2006 | November 2006 |

| 2005 | December 2005 |

| 2004 | December 2004 |

On this page:

The 2021 Urban Development Program Industrial shows:

- 138 ha of land was zoned from industrial to a non-industrial use

- there are 26,164 ha of industrially zoned land across metropolitan Melbourne with 7,856 ha of vacant supply

- 58% (4,557 ha) of this vacant supply is located within the State Significant Industrial Precincts (SSIP).

In addition to the vacant supply, there are 7,186 ha of land identified for future industrial purposes. The Southern SSIP has the least vacant land and is expected to be exhausted in the mid 2020s.

Some 273 ha of industrial land changed from vacant land to an industrial use in 2021. This is lower than the 288 ha average over the last 5 years.

Change in the zoning of industrial land

The zoning of industrial land identifies areas that have been set aside for industrial users. The amount of zoned land changes over time.

The Melbourne Industrial and Commercial Land Use Plan (MICLUP) reinforces the importance of industrial land. It puts in place a planning framework to support state and local government to plan more effectively for future employment and industry needs. Zoning is a key tool used by MICLUP to maintain industrial land supply.

Across metropolitan Melbourne 7,075.2 ha of land was zoned for industrial purposes from June 2001 to December 2021. During this period, 2,674.2 ha of industrial land was rezoned for non-industrial purposes. This resulted in a net increase of 4,401 ha.

The increase was mainly in municipalities with a State Significant Industrial Precinct (SSIP), such as:

- Cardinia

- Casey

- Greater Dandenong

- Hume

- Melton

- Whittlesea

- Wyndham.

Losses of industrial land were mainly in Melbourne’s inner and middle suburbs.

Change of industrially zoned land by municipality

June 2001 to December 2021

During 2021 no additional land was zoned for industrial purposes.

Some 138.7 ha of former industrial land was zoned to a non-industrial zone. Nearly 50 hectares of this was zoned to Mixed Use/Residential zones mainly in Glen Eira and Monash.

Rezoned industrial land by new zoning

Metropolitan Melbourne December 2020 to December 2021

Between June 2001 and December 2021, 2,674.2 ha of industrial land was rezoned for other uses. Nearly half of this land was rezoned for residential or mixed use purposes. Most of this has occurred within the inner and middle suburbs.

Industrial land was also rezoned to provide land for transport infrastructure, particularly in the outer suburbs and growth areas. Industrial land was also rezoned for conservation purposes, drainage reserves and other uses within the State Significant Industrial Precincts (SSIP).

Industrial land rezoned to/from industrial

Metropolitan Melbourne June 2001 to December 2021

Rezoning of land for industrial purposes is infrequent, however they typically involve large areas of land. Most of the land zoned for industrial purposes between June 2001 to December 2021 was previously identified as future industrial land in strategic plans.

Rezoning of industrial land for other non-industrial uses tend to be more frequent, involving the rezoning of smaller parcels of land. Around 80 per cent of rezonings from industrial to non-industrial are between 100 m2 and 5 ha.

Supply of industrial land

Industrial land supply in metropolitan Melbourne

There are 26,164.1 ha of industrially zoned land across metropolitan Melbourne with 7856.2 ha classified as vacant. Vacant land includes the “underutilised” category.

About 58% of this land (4,557.4 ha) is located within SSIPs. Some 2,950.2 hectares of vacant land is located within a number of Regionally Significant Industrial Precincts. The remainder of the vacant land (348.9 ha) is located within a number of Local Industrial Precincts.

Location of vacant industrial land by precinct type 2021

Proposed future industrial land supply in metropolitan Melbourne

In addition to zoned industrial land, a gross total of 7,186 hectares of unzoned land has been identified as Proposed Future Industrial Land in the Growth Corridor Plans, previous strategic plans and the Melbourne Industrial and Commercial Land Use Plan.

These pieces of land will undergo further planning processes, such as precinct structure planning, before they can be used for industrial purposes. Precinct structure planning will identify land to be used for infrastructure, conservation purposes, etc.

Gross area and estimated net area of proposed future industrial land by LGA, 2021

| Municipality | Gross area (ha) |

|---|---|

| Cardinia | 1,230 |

| Casey | 245 |

| Hume | 432 |

| Melton | 1,190 |

| Growth Area portion of Mitchell | 733 |

| Whittlesea | 1,639 |

| Wyndham | 1,717 |

| Total | 7,186 |

The Victorian Planning Authority (VPA) is currently undertaking the precinct structure planning process for the following Precinct Structure Plans (PSPs) that contain Proposed Future Industrial Land:

- Officer South PSP in the Officer/Pakenham State Significant Industrial Precinct

- Merrifield North Employment PSP in the Northern State Significant Industrial Precinct

- Casey Fields South and Devon Meadows PSP in the Casey Fields South Regionally Significant Industrial Precinct

- Wallan South PSP in the Wallan South Local Industrial Precinct

- Werribee Junction & Mambourin East PSP in the South West Quarries Regionally Significant Industrial Precinct

The Shenstone Park Precinct Structure Plan was approved by the Minister for Planning and gazetted on 28 January 2022 under Amendment C241 to the Whittlesea Planning Scheme. As it was approved in 2022, this land appears as unzoned in the 2021 UDP and will be included as zoned land in the 2022 UDP.

Once the Proposed Future Industrial land has undergone rezoning it will be included as zoned industrial land in the UDP.

Of the 7,856 ha of vacant industrial land across metropolitan Melbourne, 58% (4,557 ha) is located within SSIPs. In the future, the amount of vacant land in the SSIPs will increase as the Melbourne Industrial and Commercial Land Use Plan identified an additional gross 4,894 ha to be added to the SSIPs. This land will be zoned for industrial use through the Precinct Structure Planning process.

Consumption of industrial land

The UDP reports on net consumption as its primary indicator of activity. Net consumption is the amount of land that changes from developed (vacant land to occupied) minus the amount of newly vacant land (land that has changed from occupied to vacant).

Annual net consumption of industrial land by industrial precinct

2004 to 2021

Average annual consumption across metropolitan Melbourne

Prior to the Global Financial Crisis (GFC), industrial land consumption across metropolitan Melbourne averaged around 286 ha per year. Following the GFC, consumption declined significantly until 2014 when it started to increase. In 2021 273 ha of industrial land was consumed which is less than the 306 ha in 2020.

Average annual consumption across the State Significant Industrial Precincts

The State Significant Industrial Precincts are where most industrial land consumption occurs.

Consumption of land within the SSIPs can be volatile and often occurs in cycles. Following the GFC, consumption of industrial land declined within all of the SSIPs.

The Western SSIP has consistently maintained the highest average levels of land consumption and is the largest and most active industrial land market in Victoria. This precinct exhibits a pronounced cyclic pattern of consumption with regular peaks and declines.

The Southern SSIP recorded the second highest level of consumption across metropolitan Melbourne with 41.5 ha of industrial land consumed in 2021. The Northern SSIP recorded 34.4 ha of land consumed in 2021.

Modelling exhaustion rates for vacant industrial land

Measuring the supply of industrial land in relation to the consumption of land provides a basis to estimate the time at which vacant land within a SSIP becomes exhausted.

Exhaustion rate models for the most active and established SSIPs (Western, Northern, Southern and Officer/Pakenham) have been developed to provide an estimate of when vacant land is likely to be totally consumed.

The estimates of when vacant industrial land will become exhausted are calculated by subtracting a consumption rate (based on historic data) from the current amount of vacant land.

Select an SSIP from the list below to see recent and long term consumption trends in each area.

Western State Significant Industrial Precinct

The Western SSIP is the largest SSIP and is also the most active in terms of consumption. Based on currently zoned supply, vacant land could potentially be exhausted in the early 2030s. There are significant supplies of industrial land that have been identified as proposed industrial land that will substantially extend land supply to between the mid-2030s to 2040. However, a portion of this land will be required to accommodate the proposed Western Interstate Freight Terminal (WIFT) and its ancillary uses. This will result in a shorter time frame for the overall supply of industrial land in the Western SSIP.

Modelled exhaustion of industrial land Western SSIP – 2021

Northern State Significant Industrial Precinct

The Northern SSIP is the second largest SSIP and has both zoned land supply and proposed industrial land.

Consumption in the Northern SSIP has been volatile with an average rate lower than the Western and Southern SSIPs. As a result of relatively low levels of consumption, zoned vacant land in the Northern SSIP is anticipated be exhausted in the mid-2040s. However as other SSIPs start to become exhausted (Western and Southern), demand may increase in the Northern SSIP and, consequently, vacant land would be consumed more rapidly.

The Northern SSIP also contains a large amount of proposed industrial land. A portion of this land will be required to accommodate the proposed Beveridge Interstate Freight Terminal (BIFT) and its ancillary uses which will result in a shorter time frame for the overall supply of industrial land in the Northern SSIP.

Modelled exhaustion of industrial land, Northern SSIP, 2021

Southern State Significant Industrial Precinct

The Southern SSIP has the second highest consumption rate of all SSIPs and is most constrained in terms of vacant supply.

Unlike the Northern and Western SSIPs, there is no proposed industrial land that will be added to the Southern. On current zoned land, vacant land would start to become constrained in the mid 2020s. As the cost of land and rents increase, users would be expected to start to search for other locations, such as the Officer/Pakenham SSIP and Cranbourne West Regionally Significant Industrial Precinct.

Modelled exhaustion of industrial land, Southern SSIP, 2021

Officer/Pakenham State Significant Industrial Precinct

The Officer/Pakenham SSIP has the second lowest level of consumption, with a recent consumption rate of 15.5 ha per year. Using this relatively low level of consumption, it is estimate zoned land will be exhausted sometime in the mid 2040s and sometime beyond 2050 when including Proposed Industrial Land.

However, it is anticipated that consumption in the Officer/Pakenham SSIP will increase over time from the:

- redistribution of all or some of the existing demand from the Southern SSIP as vacant land within this precinct is exhausted

- creation of local industrial firms and businesses to serve the increased population growth in the Southern Growth Area

- completion of the North East Link. This will provide direct freeway linkage from the Hume Highway in the north to the Princes Freeway in the south east providing freight and logistics users another option in metropolitan Melbourne to locate their operations.

The exhaustion chart for Officer/Pakenham is based on current rates of consumption. The influence of the potential sources of increased consumption have not been included as the magnitude of their impact is unknown. The UDP will continue to monitor consumption rates and these will be incorporated in the model as they become available.

Modelled exhaustion of industrial land, Officer/Pakenham SSIP, 2021

Strategic land use policy

Industrial land in context

The Victorian economy produces around $468 billion worth of economic activity in 2020/21. This is the result of the productive activity of 3.4 million workers in over half a million businesses and the consumption of over two and a half million households. This activity takes place in offices, factories, shops, warehouses and homes. Victoria’s competitive advantage in attracting economic investment and employment relies, in part, on the availability of sufficient industrial land supply across metropolitan Melbourne to meet future demand.

The economy has transformed over the past two decades by influences such as globalisation, reduced trade barriers and technological change. While Melbourne still maintains a significant manufacturing sector, its contribution as a share of the Victorian economy has declined. There has been strong growth in knowledge and service-based industries, construction and freight and logistics to serve population growth.

Industrial land continues to be an important component in the evolving economy with uses such as:

- warehousing space for freight, logistics and retail businesses

- large and affordable spaces for creative industries

- business services firms such as testing laboratories, labour or equipment hire businesses.

Sufficient land is necessary to support Victoria’s competitive advantage in attracting economic investment. This will help meet future demand for a range of existing and emerging business and employment purposes.

While it is too early to identify the impacts of the coronavirus (COVID-19) pandemic on industrial land use, there are some early insights that may lead to further consumption of industrial land for warehousing, manufacturing or other uses:

- increased online sales

- shortening supply chains through greater storage capacity or local manufacturing

- higher levels of automation in storage and logistics land uses

- greater demand for cloud-based services which leads to buildings that need to accommodate digital storage with some of these located on industrial land.

The Melbourne Industrial and Commercial Land Use Plan

The Melbourne Industrial and Commercial Land Use Plan builds on policies, strategies and actions in Plan Melbourne and its associated 5 year implementation plan. It provides an overview of current and future needs for industrial and commercial land across metropolitan Melbourne and puts in place a planning framework to support state and local government to plan more effectively for future employment and industry needs.

To support industrial land use planning, a classification system has been put in place to assist how specific types of areas are planned. Zoned and Proposed Future Industrial Land across metropolitan Melbourne has been categorised as being a state, regional or local significance precinct. These precincts identify which land that should be retained primarily for industrial, considered for other business or employment focussed purposes, and land that could be considered for alternative uses.

Population growth prospects

Population growth is a key factor in the establishment of new industrial uses and the expansion of existing operations. Before the coronavirus (COVID-19) pandemic, Victoria was the fastest growing state in Australia, reflecting its attractiveness as a place to live, work and study.

The population grew at an average of more than 2.0 per cent per annum for most of the previous decade. Victoria’s population decreased during the coronavirus (COVID-19) pandemic period. This was the first decrease in many years.

Victoria’s population peaked at almost 6.694 million people in June 2020. Growth was below 100,000 for the year, compared with an average growth of 140,00 for the five previous years. During the year 2020-21 Victoria’s population decreased by 44,700 people to finish at 6.649 million in June 2021.

There is considerable uncertainty around the post-COVID future. It is unknown when Victoria will re-open for a return to ‘normal’ levels of overseas migration. There is a common assumption driving some published projections. It is assumed migration will return over two-to-three years. Recent projections produced by the Commonwealth and Victorian Governments contain similar assumptions and short-term results.

The 2022-23 State Budget projections show Victoria’s population growing by 0.1 per cent in 2021-2022 before growth increases to 1.1 per cent in 2022-2023 and 1.6 per cent over the following year as borders reopen.

The Commonwealth Budget projects that Victoria's population is projected to increase by 0.5 per cent in 2021-2022 before growth increases to 1.4 per cent in 2022-2023 and 1.8 per cent over the following year.

Method

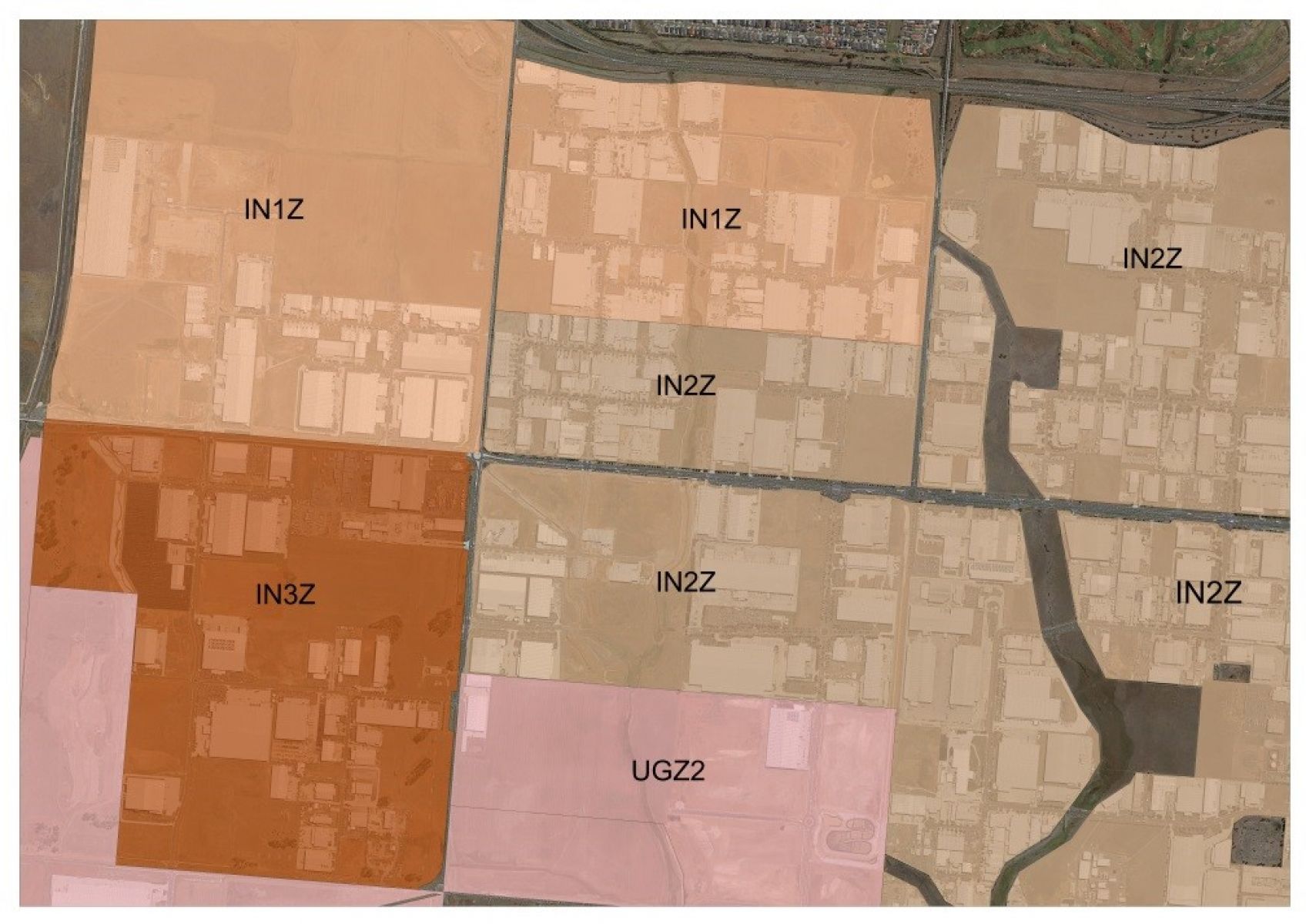

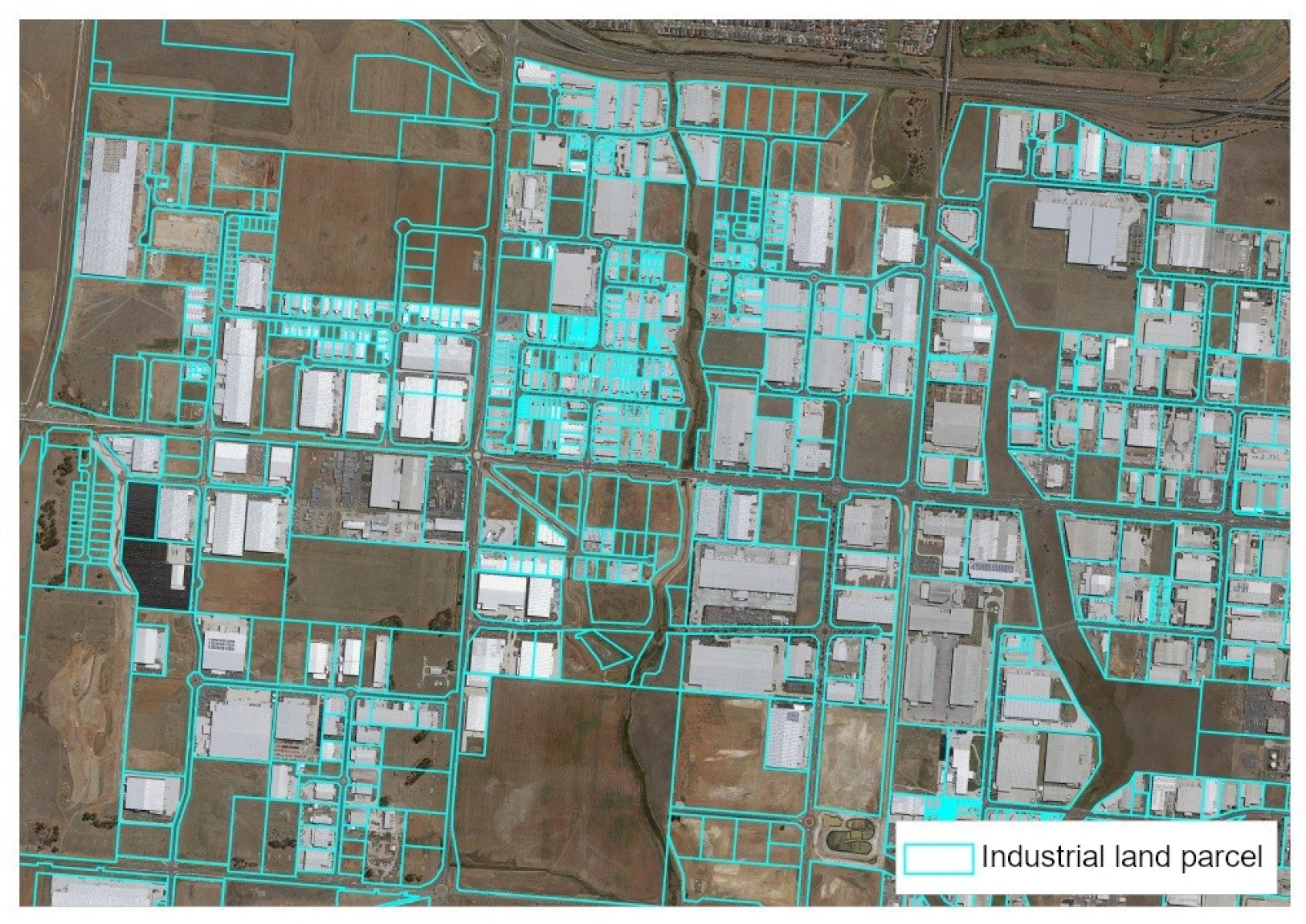

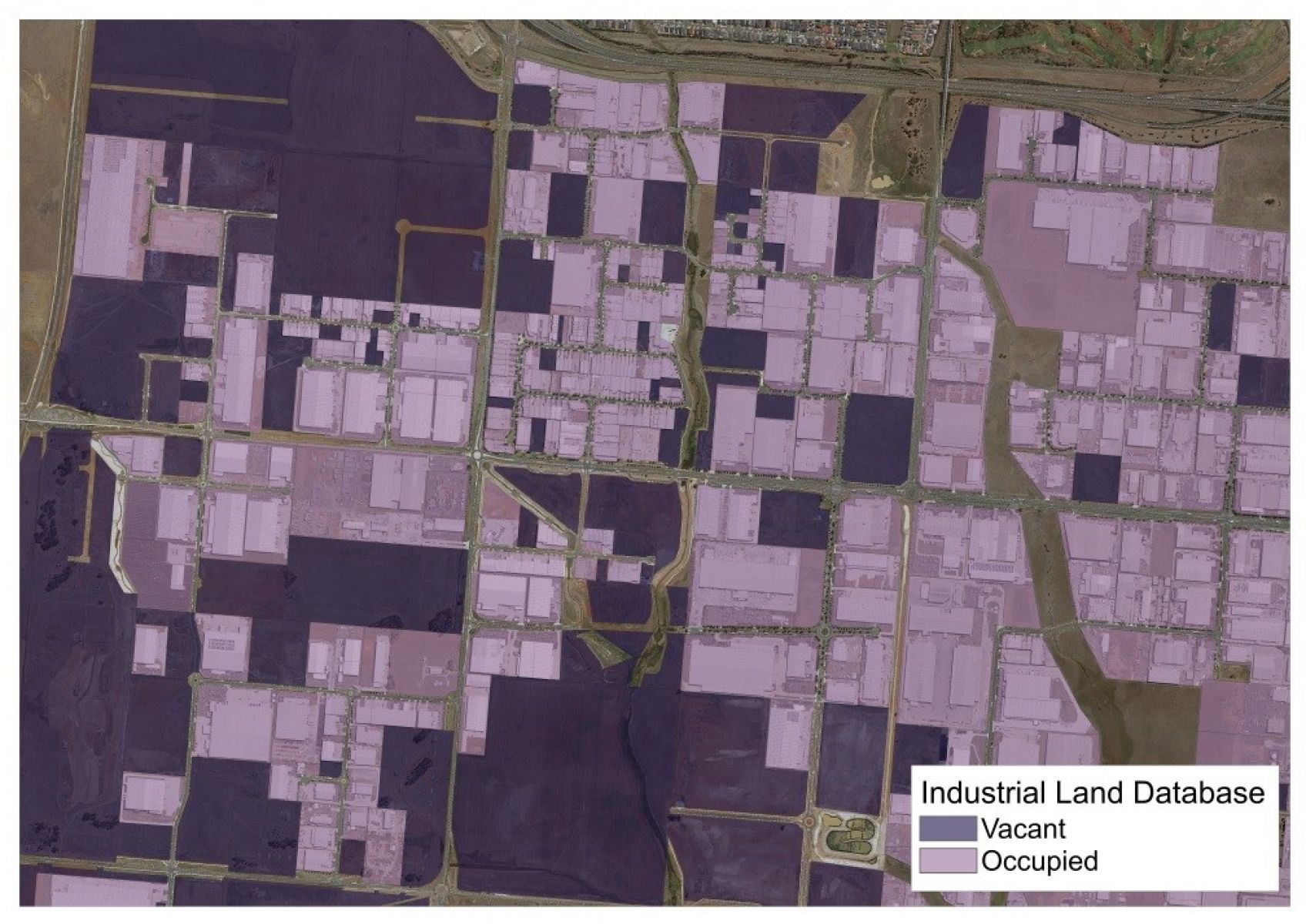

The industrial land database provides an assessment of the development status of industrially zoned land as either occupied or vacant based on a visual assessment of aerial photography.

Each calendar year is measured using aerial photography taken at the end of that calendar year or early the next year. Occupied land includes land occupied by buildings, container parks, informal carparking, quarries, agricultural uses and hardstand storage areas. Unused land is assessed as vacant.

The assessment provides a conservative estimate of the amount of vacant land across metropolitan Melbourne.

There are 3 steps to produce this data:

1. Identify areas that are zoned for industrial purposes from the planning scheme. This provides the areas in metropolitan Melbourne that are or can be used for industrial purposes.

2. Use the industrial planning scheme zones to identify the cadastral base parcels that are zoned industrial. This provides the individual properties that are zoned for industrial purposes.

3. Make an assessment from geo-rectified digital aerial photography of the status of the land as either occupied or vacant.

The data has been collected annually from 2004 to 2021 to produce a time series extending over 16 years. The data is collected on a calendar year basis.

Get the data

Our easy-to-use online mapping tool allows you to access and use the UDPs spatial data.

Spatial data in a number of formats including ESRI shp and MapInfo TAB. You will require GIS software to use this data.

Definitions of spatial data attributes are available in the Data Dictionary below.

Download the data tables used to create the graphs shown in the results.

For access to historic data from 2004 to 2021, email: policy.performance@delwp.vic.gov.au.

Glossary

Industrial land consumption is the process of land changing from vacant to occupied. This typically occurs when vacant land starts to be used for some type of use including: buildings, storage areas, car parks, quarries, etc.

Occupied industrial land can also become vacant which typically involves the demolition of buildings or removal of storage facilities. Returning occupied land to land supply creates negative consumption.

Net consumption, which is the measure reported in the UDP, is the amount of land that changes from developed (vacant land to occupied), less the amount of newly vacant land (land that has changed from occupied to vacant). This recycling of land accounts for net negative consumption that occurs in some inner and middle suburbs.

Consumption rates are based on a long-term consumption trend (2004 to 2021) and a recent consumption trend (2014 to 2021) for each Significant Industrial Precinct (SSIP). The long-term consumption rates are generally lower than the recent consumption trends. This provides a range of potential times when vacant land becomes exhausted.

The method adopted in this report creates a linear exhaustion rate, however in practice, land supply in the SSIPs would become constrained prior to all vacant land being consumed. This is because:

- the amount of new development would start to decline as land prices increase in response to increased scarcity. Users might be priced out of areas and search for other locations.

- not all zoned land is suitable for development as either built space or non-built space (such as a storage yard) due to the configuration of the land such as area, shape or cost of providing infrastructure.

This modelling provides a useful estimate of the how the SSIPs will accommodate growth and the pressures they may encounter in the future.

The amount of vacant land and proposed industrial land are refined by using these assumptions:

- All vacant and underutilised lots over 4 ha have been discounted by 20% to model potential subdivision.

- All vacant and underutilised lots below 4 ha have not been discounted further as it is assumed that these lots will be consumed as currently configured.

- All land is assumed to be useable, however, in reality some pieces of land will be used for other purposes (such as road reservations) or are not physically suitable for industrial development.

All Proposed Industrial land has been discounted in a 2-step process:

- 15% discount to account for infrastructure such as major roads, drainage reserves and open space.

- 20% discount to model potential subdivision such as roads within subdivisions.

The Melbourne Industrial and Commercial Land Use Plan identified a number of Local Industrial Precincts.

The purpose is to provide for a range of local industry and employment opportunities that support local communities and other businesses operating in the local area. They will be planned to support local service trades and the needs of smaller businesses serving more localised markets.

They should be retained for industrial or employment purposes unless a planning authority has identified them for an alternate non-employment purpose.

Some evidence of the use of land. This includes buildings, hardstand storage areas, carparks, partly constructed buildings, etc.

A land-use and infrastructure plan to guide development of the area over time. It sets out the intended future land uses, infrastructure and development guidelines.

These are areas that have been identified for future industrial development in the growth corridor plans and previous metropolitan strategic plans, such as Melbourne 2030, Growth Corridor Plans and Plan Melbourne. The Melbourne Industrial and Commercial Land Use Plan has reconfirmed these areas as well as clarifying the industrial role some areas will play in the future. This land is not currently zoned for industrial purposes and requires either the approval of a Precinct Structure Plan (PSP) or rezoning to an industrial zone. Once the land is zoned for industrial purposes it is assessed as either Occupied, Vacant or Underutilised.

The Melbourne Industrial and Commercial Land Use Plan identified a number of Regionally Significant Industrial Precincts. The purpose is to provide opportunities for industry and business to grow and innovate in appropriate locations for a range of industrial and other employment uses that can contribute significantly to regional and local economies.

They will be retained and planned to allow a range of industrial and other employment uses, and where appropriate, new and emerging types of businesses that require access to affordable and well-located land to grow and innovate.

They may serve broader city functions or support activities which benefit from scale with some precincts offering opportunity to transition to a broader range of employment opportunities offering a higher amenity to workers and economic vibrancy.

Plan Melbourne – 2017 to 2050 identified five State Significant Industrial Precincts (Western Industrial Precinct, Northern Industrial Precinct, Southern Industrial Precinct, Port of Hastings Industrial Precinct and Officer-Pakenham Industrial Precinct. The purpose is to provide strategically located land for major industrial development linked to the Principal Freight Network and transport gateways. They will be protected from incompatible land uses to allow continual growth in freight, logistics and manufacturing investment.

Used to identify industrially zoned land being used for agricultural or residential and agricultural use in selected municipalities. Previous UDPs (up until 2019) identified land as occupied. Identification of this underutilised land adds to the land classified as vacant. This category only applies to the municipalities of Brimbank, Cardinia, Casey, Frankston, Greater Dandenong, Hume, Melton, Mornington Peninsula Whittlesea and Wyndham.

Land is vacant and no use is occurring on the land.

The planning scheme zones identified as industrial for the Urban Development Program are:

- Industrial 1, 2 and 3 Zones

- Business 3 and 4 Zones

- Commercial 2

- Special Use 2, 3, 4, and 5 Zones in the City of Hobsons Bay, Special Use 1 Zone in the Shire of Mornington Peninsula (which is identified for industrial uses associated with the Port of Hastings and is not a general industrial zone) and Special Use Zone 6 in the City of Monash

- Comprehensive Development Zone 2 in the City of Hume and Comprehensive Development Zone 2 in the City of Whittlesea

- Precincts with Activity Centre Zones that are industrial in character within the City of Casey, City of Merri-bek and the City of Whittlesea

- Land within the Melbourne and Moorabbin Airport Business Parks

- Urban Growth Zone land identified as industrial in Precinct Structure Plans (PSP); Cardinia Road Employment PSP, Cranbourne East PSP, Cranbourne West PSP, Craigieburn North Employment Area PSP, Diggers Rest PSP, East Werribee Employment Precinct, Minta Farm PSP, Mt Atkinson PSP, Sunbury South PSP, Tarneit North PSPs, Toolern PSP, Truganina Employment Area PSP, Westbrook PSP and Wollert PSP.

Page last updated: 11/06/23